Have you ever opened your mail to find a complicated-looking document from your health plan provider that, in big, bold letters, says, “This is Not a Bill”? If so, you’re not alone. That document is your Explanation of Benefits (EOB), and for many people, it’s a source of confusion. It’s tempting to toss it in the recycling bin, but doing so means missing out on one of the most powerful tools you have for managing your healthcare costs.

This guide is here to simplify the EOB. We will break down each section, explain the confusing words it has in simple terms, and show you exactly what to look for. By the end, you’ll understand how to read your EOB with confidence, spot potential errors, and use it as a tool to become a more savvy patient.

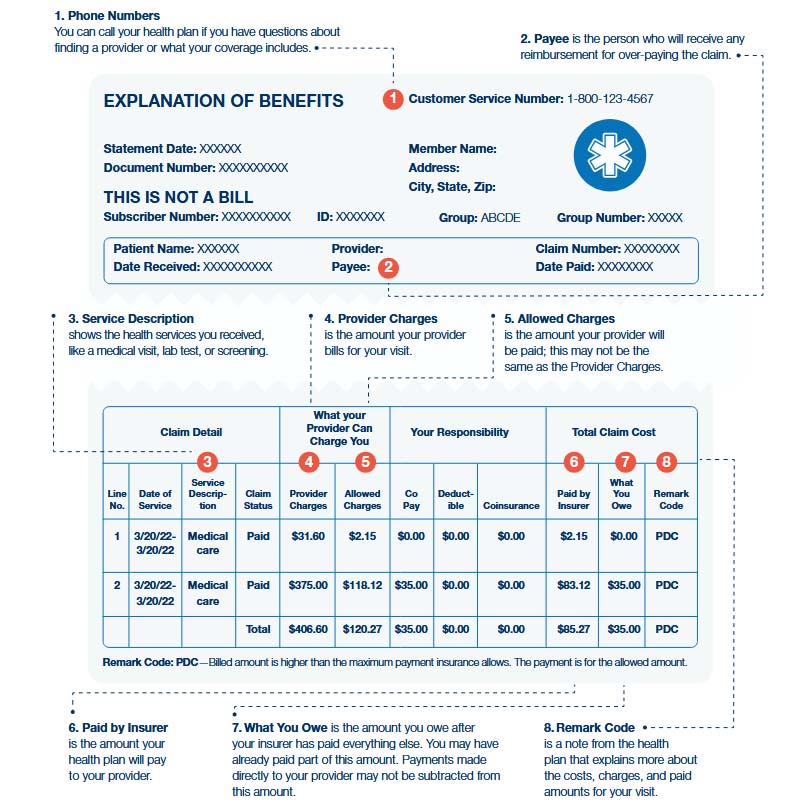

First things first: an EOB is a record, not a bill. It is a summary of the medical services or products you received and shows how your health plan treated each part of the claim. Think of it as a receipt that breaks down what your provider charged your insurance for, what your health plan agreed to pay, and what part of the cost you are responsible for paying.

Reading your EOB is an important step in taking control of your health spending. It allows you to:

While every EOB looks a little different, they all contain the same basic information. Let’s walk through the key sections you’ll find on most statements.

By reviewing your EOB carefully, you can avoid overpaying or being charged for mistakes.

This section is usually at the top of the EOB and contains your information. It’s important to give this section a quick scan to make sure everything is correct.

Why it matters: Verify that the EOB is for you. Errors can happen, and if you spot someone else’s information, the claim isn’t yours.

This is the core of the EOB. It lists the specific services you received at the hospital or doctor’s office.

What to do: Compare this information to your personal medical records or receipts. If something doesn’t look familiar or if you think you did not receive a service that is listed, reach out to your healthcare provider’s office to ask about it.

Savvy Patient Tip: Always check the Date of Service and Service Description against your own calendar and records to confirm that you actually received that service on that day. Mistakes here are more common than you might think.

This part of the EOB causes the most confusion, but it’s also where you can find the most important information.

This section often explains why the insurance did not pay for certain services or amounts. Common reasons that your plan may not pay are if a claim is denied or if service is not covered under your plan.

This section breaks down the portion of the bill that you will likely have you pay. It is the most important part to understand for your budget.

Savvy Patient Tip: Compare the “Your Responsibility” section of your EOB to any bills you receive from your provider. If the amounts don’t match, contact your provider to fix the issue.

Once you understand your EOB, you can use it as a tool to take control of your healthcare budget.

Your EOB gives you a clear picture of what your health plan covers for your prescriptions. Sometimes, especially if you have to pay a high deductible, the “Patient Responsibility” amount for a medication can still be very high. This is where LowerMyRx becomes an essential part of your savings toolkit.

Before you go to the pharmacy, search for your medication on the LowerMyRx app or website. You might find that the LowerMyRx discount price is even lower than your copay or the price you’d pay towards your deductible. By comparing prices, you ensure you are always getting the lowest possible cost, helping you keep your out-of-pocket expenses low.

Your Explanation of Benefits or EOB is more than just a piece of paper; it’s a tool you can use to understand and take control of your medical expenses. By taking a few minutes to read and understand it, you can verify what medical services you are getting, catch costly errors, and get a clear picture of your healthcare spending. By treating your EOB as a key part of your health journey, you move from being a passenger to being the driver. You are now a more savvy patient.

Q1. Is an EOB a bill? Should I pay the amount it shows?

No, an EOB is not a bill. You should not send any payments after you get an EOB. Wait for the actual bill to arrive from your medical provider’s office before paying. The EOB is a record to help you understand what that bill will be.

Q2. What should I do if I think there is an error on my EOB?

Your first step should be to call your medical provider’s billing office. Point out the specific charge and date of service you are questioning. Most errors are simple mistakes that can be corrected easily over the phone.

Q3. Why would my health plan deny a charge?

A charge might be denied for several reasons: the service may not be a covered benefit, you may have used an out-of-network provider, or it might require prior authorization. Your EOB should provide a reason code, and you can always call your insurance company for a more detailed explanation. Your EOB will list the best phone number to call for these issues.

Q4. How long should I keep my EOBs?

It’s a good practice to keep your EOBs and corresponding medical bills for at least one full year. If you have an ongoing or complex medical issue, you may want to keep them for longer as part of your personal health record.